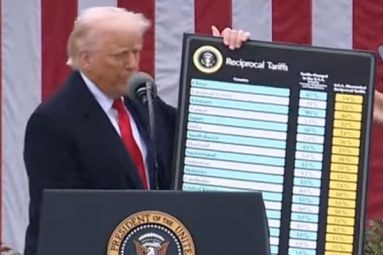

The imposition of tariffs by US President Donald Trump has created turmoil worldwide, driving Indian stock markets down to their lowest point in ten months and erasing more than Rs 20 lakh crore in investor wealth almost instantly. The Sensex index opened nearly 4,000 points lower, reflecting a decline of over 3.5% compared to its last trading session, while Nifty dropped more than 1,000 points this morning. This steep decline follows a significant sell-off in Asian markets, triggered by concerns over Trump's aggressive policies, with US futures indicating large losses as trading is set to resume this evening. The tariffs, presented as the beginning of a "golden age" for American industries, aim to challenge trade practices that Trump views as inequitable. These measures are targeted at specific countries and can reach up to 50%, with India facing a tariff of 26% in addition to a baseline duty of 10% applicable to all nations.

Despite the global market turmoil, a resolute Trump remained unfazed, likening the tariffs to a necessary "medicine" to rectify existing issues during a press briefing this morning. Early trading saw the Sensex plunge by 3,939.68 points to reach 71,425.01 after markets reopened at 9 am following the weekend break. During this same period, Nifty saw a decrease of 1,160.8 points, dipping to 21,743.65. The Sensex, representing India's top 30 firms listed on the Bombay Stock Exchange, had fallen more than 3,000 points by noon, while Nifty fell below the 22,000 threshold. Additionally, the rupee opened weaker against the US dollar, dropping by 30 paise to 85.74.

Experts caution that Trump's tariffs were likely to instill anxiety in Indian markets, suggesting that the nation now requires significant fiscal reforms to shield its economy from the repercussions of the global trade conflict. Ajay Bagga, a market analyst, remarked that India will experience challenges not because of internal factors, but due to its interconnectedness in global financial flows. He emphasized the necessity for a comprehensive fiscal, monetary, and reform package to safeguard the domestic economy from an impending global economic downturn. Sunil Gurjar, a research analyst registered with SEBI, noted that Nifty50 has fallen below its first support level and is approaching the second; further declines could signal an extended downward trajectory.

The Asian markets, which were the first to be affected, have endured the greatest losses as the sell-off intensified due to Trump's tariffs. This decline has particularly impacted the exchanges in China, Japan, Taiwan, and Hong Kong. In China, stock prices have plummeted by more than 4% following the government's implementation of retaliatory tariffs at 34% on US goods. In Hong Kong, the Hang Seng index has experienced a decline exceeding 10%. Meanwhile, Japan's Nikkei index has dropped at least 6.5%, having witnessed an initial plunge of over 8% in early trading. Taiwan's primary index fell nearly 10%, and Singapore's index also saw a drop of more than 8%. The outlook for Wall Street is bleak as well, with futures on the New York Stock Exchange indicating significant declines, forecasting severe losses once US markets resume trading on Monday.

In addition to triggering a steep decline in equity markets, Trump's trade strategies have raised concerns about a potential global recession, leading to anxiety among financial analysts. Stephen Innes from SPI Asset Management expresses apprehension that a global downturn may be imminent. He stated, "The market is again in a state of free-fall, breaking through lower thresholds. The Trump administration shows no signs of backing down, treating the tariffs as a triumph rather than a point for negotiation."